Gold is an excellent store of wealth. Many banks, governments, and family offices park their money in gold in times of economic uncertainties. High demand for the precious metal drives the business for gold mining companies such as Barrick Gold Corp (NYSE: GOLD). Consequently, gold stocks tend to appeal to many investors in times of pessimistic economic outlook.

With many investors anticipating a recession in 2023, you can understand why many are looking for the best gold stocks to buy now. If you’re looking for gold stocks, there are many options out there for you to choose from.

But gold stocks are not made equal, which is why you might have questions like these: Should I buy Barrick Gold stock? Is Barrick Gold stock a buy or sell? And what is the Barrick Gold stock forecast?

Although it can be lucrative, mining gold is a difficult business. It involves high costs in exploration and product, requires highly skilled personnel, and volatile gold prices can cause sharply fluctuations in sales and profit. Moreover, multinational mining companies are susceptible to political interference in host countries.

With all this in mind, it helps to assess your options carefully when selecting gold stocks to buy.

Source: Pixabay

This article will help you decide whether Barrick Gold Corp (NYSE: GOLD) stock is a buy or sell. The article explores Barrick Gold’s business model, financial performance, challenges, and opportunities. Moreover, you’re going to find out Barrick Gold stock price prediction. On this, you’ll see Wall Street analysts’ average Barrick Gold stock forecast as well as the stock’s highest and lowest price targets.

Because it is a good idea to invest in businesses that you understand well, let’s first get to know more about Barrick Gold.

Barrick Gold Corporation (NYSE: GOLD) Overview

Barrick Gold Corporation is a Canadian multinational mining company. Although the company primarily produces gold, it has a copper business. Founded in 1983, Barrick is headquartered in Toronto, Canada.

Source: Barrick Gold

Through acquisitions and organic expansion efforts, Barrick has grown to be one of the world’s top gold producers. The company has mining operations in the Americas, Africa, the Middle East, and Asia Pacific.

In its earlier incarnation, Barrick was an oil and gas company. It ditched the energy business after suffering heavy financial losses and decided to focus on gold mining. It later saw an opportunity in copper mining and decided to venture into that business as well.

Barrick Gold CEO Mark Bristow is a mining industry veteran. The outspoken gold executive also served as an officer in the South African military.

Barrick Gold’s Business Model

Barrick Gold Corp (NYSE: GOLD) mines and sells gold and copper. While the company primarily makes money from operating its own mines, it also has joint venture mines. Moreover, the company has interest in other mining companies’ projects through which it earns royalties.

Although the company has diversified into the copper business, the gold business contributes the bulk of its revenue and profit.

Barrick has more than a dozen active mining projects. Its mining operations are located in the U.S., Canada, Chile, Argentina, the Congo, Zambia, and Dominican Republic. It also has mining projects in Saudi Arabia, Mali, Tanzania, and Papua New Guinea.

Source: Barrick Gold

Barrick produces millions of ounces of gold. It produced 4.1 million ounces of gold in 2022 and aims to produce as much as 4.6 million ounces in 2023.

Barrick Gold’s Financial Performance

Barrick Gold’s financial year begins in January and ends in December. The company releases quarterly reports on its financial performance and caps it with a consolidated annual report at the end of the year. Let’s take a look at the company’s recent financial performance:

Revenue

Barrick Gold generated revenue of $2.64 billion in the first quarter of 2023. Although the revenue dipped about 7% year-over-year, it exceeded Wall Street’s consensus estimate by nearly $80 million. The quarterly revenue decline was largely a function of low production as Barrick Gold shut some of its projects for maintenance during the quarter.

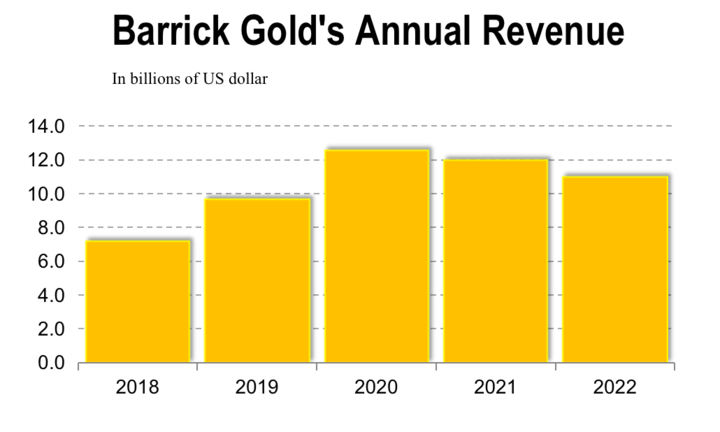

The company generated revenue of $11 billion in 2022. Barrick’s revenue has increased at a compound annual growth rate of about 10% over the past 5 years. But Barrick’s annual revenue growth hasn’t been consistent as you can see from the chart below. In 2023, Barrick’s revenue is projected to grow about 9% to $12 billion.

Net Income

Barrick has been consistently profitable on quarterly and yearly bases for years. The company made a profit of $120 million in the first quarter, which worked out to earnings per share (EPS) of $0.7 or $0.14 on an adjusted basis. The adjusted EPS exceeded Wall Street’s consensus estimate of $0.12. The quarter benefited from strong gold prices.

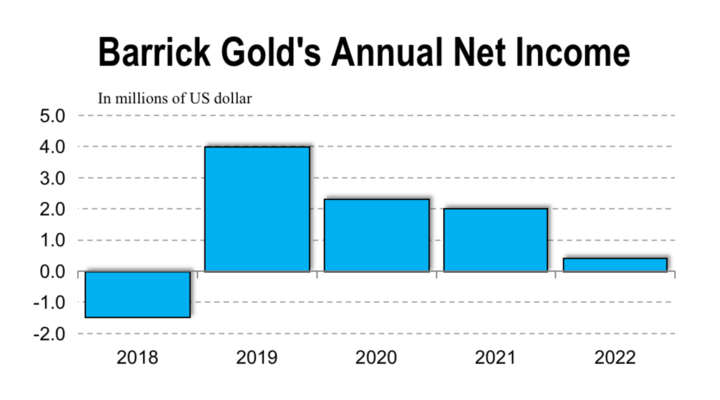

But Barrick’s profit dropped almost 80% to $432 million in 2022. The steep profit dip was caused by a huge write down of the value of a gold project in South Africa. Although Barrick has been mostly profitable, its profit can fluctuate as illustrated in the chart below.

Profit Margins

The gold miner achieved a gross profit margin of about 32% in 2022, representing a decline from 41% in the previous year as the company faced high costs. The company’s operating margin came to 13.4% and net profit margin came to 3.9% for the year.

These are Barrick’s lowest profit margins in several years and they’re a sign of the impact of inflation on the company’s business. The company has a chance to improve its operational efficiency in the coming years as the inflationary pressure abates.

Cash Position and Balance Sheet Condition

Money isn’t a problem for Barrick Gold. The company generated $776 million in cash flow from operations in Q1 2023. It finished the quarter with a cash balance of $4.4 billion.

Barrick also boasts a solid balance sheet with $46 billion assets and less than $15 billion in liabilities. The company has a respectable current ratio of 2.7 and debt-to-equity ratio of 0.21.

Barrick Gold (NYSE: GOLD) Stock Analysis

GOLD Stock Trading Information

Barrick stock is dual-listed in the U.S. and Canada. The company went public in 1987.

In the U.S., Barrick stock trades on the NYSE under the “GOLD” ticker symbol and the stock price in the U.S. dollar. In Canada, the stock trades on the Toronto Stock Exchange under the “ABX” symbol and the stock price in the Canadian dollar.

Regular trading hours for Barrick stock are from 9:30 a.m. to 4:00 p.m. ET on weekdays. If you desire more time to trade Barrick stock, you can take advantage of extended trading hours. You can start trading the stock from as early as 6.30 a.m. to as late as 8.00 p.m.

Barrick Gold Stock Split History

The gold miner has split its stock twice since the IPO. Barrick Gold stock split occurred in March 2003 and it saw the company implement a 2-for1 split. As a result, a position of 1,000 shares in the stock expanded to 2,000 shares after the split.

The second Barrick Gold stock split came in June 2004 and it saw the company implement a 2-for-1 split. Similarly, a position of 1,000 shares before the split expanded to 2,000 shares following the split.

After all the splits, an original position of 1,000 shares in Barrick stock has now increased to 4,000 shares.

Although a split is generally intended to have a neutral effect on a stock price, many stocks rise following splits. That happens because a split makes a stock more affordable to retail investors, which can generate more demand for the stock and lift the price.

Barrick Gold Stock Dividend History

Source: Pixabay

The company has been paying dividends consistently for decades. It recently declared a quarterly cash dividend of $0.10 per share payable on June 15. Barrick Gold stock currently offers a dividend yield of 2.7%, which is higher than the sector average of 1.9%.

In 2022, Barrick introduced a performance-based dividend program where it pays an additional dividend based on the size of its net cash.

Barrick (GOLD) Stock Performance

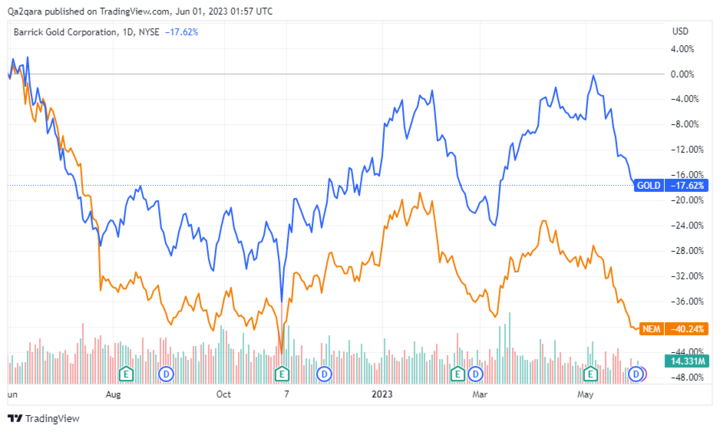

Barrick stock price has retreated about 5% year-to-date. But that is still better than the nearly 18% pullback in the rival Newmont Corporation (NYSE: NEM) stock. Over the past year, GOLD stock has declined 17% while Newmont has plunged nearly 40%.

At the current price of about $17, Barrick (GOLD) stock has retreated nearly 70% from its all-time high of about $55 reached in 2011. Consequently, Barrick (GOLD) stock market cap has dropped to about $30 billion.

These are some of the factors that affect Barrick stock price:

These are some of the key drivers of Barrick (GOLD) stock price:

● Financial performance: Investors pay close attention to Barrick’s financial results. The stock usually goes up when investors perceive the reported financial results to be strong and falls when investors disapprove of the results.

● U.S. dollar strength: Gold is priced in the U.S. dollar in international markets. As a result, a stronger U.S. dollar makes gold more expensive for those holding foreign currencies, which can diminish demand for the precious metal and subsequently reduce investor appetite for gold stocks.

● Economic conditions: Gold demand and prices tend to swing in step with changes in global economic conditions. Changes in gold demand consequently affects Barrick’s stock price.

● Company news: Investors pay attention to Barrick’s updates on exploration progress, production plans, and expansion efforts. Consequently, Barrick stock can rise or fall depending on whether investors welcome or disapprove of the company’s actions.

Barrick (GOLD) Stock Forecast

Source: Pixabay

The pullback in Barrick stock price has left many investors wondering whether the gold stock is undervalued. Consequently, many are interested in Barrick stock price prediction to try to assess the stock’s outlook.

According to Wall Street analysts, Barrick stock is more likely to rise from its current level than fall further. Wall Street’s average Barrick (GOLD) stock price target of $23.62 implies nearly 40% upside potential. The peak Barrick stock price forecast of $28 suggests as much as 65% upside. And even the stock’s base price target of $19 indicates a modest upside.

Barrick Gold’s Challenges and Opportunities

Source: Pixabay

Many opportunities lie ahead for Barrick in both gold and copper markets. But the company has to navigate several challenges to remain in business, grow its sales, and improve its profitability. Let’s examine Barrick’s challenges and opportunities.

Barrick Gold’s Risk and Challenges

● Competition: Since gold’s availability is limited, companies that can discover and mine it quickly can be more successful. Barrick faces fierce competition from the likes of Newmont Corporation (NYSE: NEM), Agnico Eagle Mines (NYSE: AEM), and Kinross Gold Corporation (NYSE: KGC) in the pursuit of high-quality mines and competent personnel.

● Regulations: Mining is a critical sector to the economy of many countries. As a result, the sector can be tightly regulated in some countries. Canada, for instance, has limited Chinese investments in its key sectors. Such regulatory curbs can limit Barrick’s partnership opportunities and slow its growth.

● Climate change: Frequent and severe drought and floods are some of the consequences of climate change. Such extreme weather conditions can disrupt Barrick’s mining operations, such as when mine sites get flooded.

● Volatile gold prices: Although gold price is generally on the rise, it is prone to frequent fluctuation. Adverse swings in gold prices can compress Barrick’s sales and profitability. And weak earnings can have a huge adverse impact on Barrick stock.

Barrick’s Competitive Advantages

Despite the challenges facing, Barrick has many strengths. Let’s take a look at the company’s competitive advantages:

● Strong financial position: Barrick has more cash and less debt than its major rival Newmont. Because of its less debt, Barrick has a lower risk of defaulting on its financial obligations when its profit takes a dip. Additionally, the substantial cash accords Barrick greater financial flexibility to pursue expansion programs.

● Exploration expertise: Exploration is to the mining industry what research and development is to technology and pharmaceutical companies. Barrick has proved to be a master of exploration, which has helped it build a portfolio of world-class gold and copper mines. The company focuses on long-life, top-quality mining projects.

● Geographic diversity: Barrick’s operates span several continents. Mining companies are exposed to many political risks. The geographically diversified footprint helps the company reduce geopolitical risks in its business. The company has further minimized its political risks by hiring local workforce rather than relying on expats.

● Diversified business: While many of its competitors rely on gold production, Barrick can count on both gold and copper sales. Copper production may currently account for only a tiny fraction of Barrick’s sales and profit, but it still helps spread the company’s risks.

● High barrier to entry: While Barrick has Newmont (NEM), Agnico Eagle Mines (AEM), and Kinross Gold Corporation (KGC) to content with for market share, there is a low risk of startups coming up and disrupting the scene. With its heavy capital and regulatory requirements, the mining industry has prohibitively high hurdles to entry for newcomers. That limits new competitive pressure for Barrick.

Barrick Gold’s Opportunities

Barrick has significant revenue growth and profit potential. Let’s examine the company’s opportunities.

● Projects expansion: There is room for Barrick to expand its existing mines to produce more gold or produce copper in addition to gold. Increased output can lead to more revenue and profit for the company.

● Acquisitions: Some of Barrick’s projects are operated as joint ventures. For example, it runs the Nevada mines in partnership with Newmont. There is a chance for Barrick to increase its stake in those joint projects. For example, as partners like Newmont get into deals, they may be forced to divest some assets that Barrick can pick up.

● Copper production: The copper business currently accounts for about 20% of Barrick’s profit. The company aims to raise the copper division’s contribution to its bottomline to 30% in the coming years. The shift to renewable energy and electric vehicles is boosting copper demand, which is widening the market opportunity for Barrick.

How to Invest in Barrick Gold (NYSE: GOLD) Stock

If you’re considering investing in Barrick stock, there are several ways you can approach it. Let’s explore the three popular methods you can apply to make money with Barrick Gold stock.

1. Buying and Holding Barrick Gold Shares

If you’re looking for long-term exposure to Barrick stock, buying and holding shares in the mining company is the best investment method to pursue. With this method, you buy and hold Barrick shares in your portfolio for several months or years.

In this approach, you bet that Barrick stock price would have gone up by the end of your investing period.

While holding Barrick shares grants shareholder voting rights and makes you eligible for dividends, this investing method requires a large starting capital. Moreover, holding shares typically requires a long wait before you see returns.

2. Trading Barrick Gold Stock Options

Let’s say you expect the Barrick stock price to go up. In that case, you purchase a Barrick stock call option. This option allows you to buy Barrick shares at a lower price than the market price at a future date. Many investors use call options to secure a discount entry into a stock for a long position.

If you anticipate Barrick stock to drop from its current price, you purchase a put option. This option allows you to sell Barrick shares at a higher price than the market price at a future date.

While options trading allows you to obtain favorable prices in advance for your future trade, it has several drawbacks. If you’re looking to use a call option, purchasing the option is an extra cost besides the capital you need to buy for the shares. Because a single option represents 100 shares, you have little control over your starting capital.

3. Trading Barrick Stock CFD

If you’re looking for a lightweight method to invest in Barrick stock, CFD trading can be a great option. CFD trading involves speculating on a stock’s price direction. It requires less starting capital than the other methods. Moreover, in CFD trading you can make money both when Barrick stock is rising as well as when it is falling.

In CFD trading, you’re paid the price difference from a stock movement. Your profit is based on the price change and number of contracts bought. Let’s say you’re predicting that Barrick stock price will go up and you purchase 100 contracts for that trade.

Your prediction turns out to be correct and the stock price moves from $17 to $20 in a day or week, representing a $3 price change on the upside. In that case, your profit will be $300 ($3 multiplied by 100 contracts). If you bought 1,000 contracts, your profit would be $3,000 on that trade.

It works the same way if you predicted that Barrick stock would fall and it did.

Why Trade GOLD Stock CFD With VSTAR

If you’re interested in trading Barrick gold stock CFD, consider using VSTAR. With VSTAR, you can start trading GOLD stock CFD with as little as $50. The platform also offers leverage to help you boost your trade.

Moreover, VSTAR’s tight spreads and low trading fees can maximize your profit. Another appealing VSTAR feature is fast order execution. And for your peace of mind, VSTAR is a fully licensed and regulated CFD trading platform.

How to Trade GOLD Stock CFD With VSTAR

Trading GOLD stock CFD is easy and straightforward. The first step is to register for a VSTAR account, and for that you only need your email address or phone number. The next step is to fund the account. VSTAR supports all the popular deposit methods, ranging from bank transfers to credit cards to digital wallets.

Once the account is set up and funded, you can start trading Barrick Gold stock CFD.

If you’re new to CFD trading and want to test your skills before investing real money, VSTAR provides a demo account that gives you up to $100,000 in virtual money trading practice.

Consider signing up for a VSTAR account today to start trading GOLD stock CFD.

Barrick (GOLD) Stock CFD Trading Tips to Help You Maximize Profitability

● Use risk management features: Successful traders try to balance their risk and opportunities. Take advantage of limit and stop order features in CFD trading to minimize your risks.

● Seek help when in doubt: In trading, a simple mistake can cost you dearly. If something about the trading platform you’re using isn’t clear to you, seek help. If you’re using VSTAR, you can access human support at any time during trading hours.

● Mind about the fees: There are costs involved in CFD trading. But costs can quickly erode your profit. Your best bet is a CFD trading platform with low fees, so you can retain much of your gains.

Final Thoughts

Barrick Gold (NYSE: GOLD) has the balance sheet strength, operational expertise, and many opportunities to succeed in its business. But volatile gold prices, stringent regulations, and intense competition are risks to watch in this stock. If you would rather pursue short-term profit than commit to a long-term position in Barrick, you may want to try trading Barrick stock CFD.